The economic growth of India witnessed a slowdown. Although the slowdown has now stabilized, the economy is upside down right now. Not to be perceived that there will be a sharp movement of growth to 8% or something like that. But this stabilization can be predicted to bring the economy to 7%.

After few more quarters of GST disruption, the Indian economy will start seeing the full impact of the GST. In the coming financial quarters, Indian economy will not only leave behind the disruptions created by GST and demonetization but will also catch up with the growth that was slowed down in the process. However, the growth rate is unlikely to reach 8%.

INFLATION IS A BIGGER CONCERN IN CURRENT CONDITION

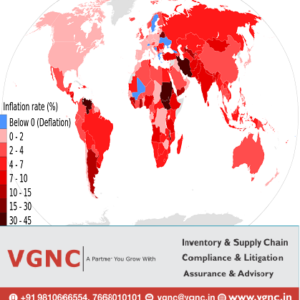

Inflation is a bigger and imminent concern. Commodity prices are the drivers of inflation concerns in India. This is the reason they are considered huge concern for the Indian Economy as the government has very little control over such drivers.

Policy disruption in the past has left the economy weak over the years. The monetary policy in current times of keeping the interest rates at a point where they are is not negative. But if the rates rise, one would have to become cautious. The band, right now, is 4 percent plus or 2 percent minus. This also gives us a clear idea of when the intervention will be needed.

Top accounting firms in Delhi

INFLATION TARGETING IS THE RIGHT DIRECTION

India, as a developing nation, focuses on the growth of its economy and job creation. The Indian economy, however, must maintain discipline in terms of targeting inflation even if it means a slowdown in growth. The inflation target is at a reasonable range of 4%plus or 2%minus. Being a developing economy, we cannot afford to have 6% inflation rates. Thus, it is good to prevent the level from breaching. Inflation is hard to predict but with inflation targeting efforts it can be kept in a favorable range.

RISK FOR INDIAN ECONOMY IN TURNING MACRO SITUATION

• The commodity prices are a controlling factor but it cannot be controlled by the government

• Monsoon is one of the major factors contributing to the economy but is unpredictable

• Elections being around the corner, activities on the fiscal side poses as a potential downside.

• The international effect – the tightening bank cycles all across the world could lay an impact on economy of India

top business consulting firms india

Major reforms such as GST, demonetization, bankruptcy reform, etc. is creating a short period of misbalance but these reforms by the government will pay off by creating an atmosphere where it is easy to do business.

Although there is some space for the government to move near the range of 3.2percent, international investors can get the red flags from the significant breaching of it. As an economy performing under the pressure of inflation, experimenting with bigger fiscal deficit can prove to be detrimental.

The higher fiscal deficit will add to the already high pressures of Indian Economy. It is favorable to have a larger fiscal deficit if an economy is trying to address adverse situations like a recession. Indian Economy is advancing at right pace by targeting inflation and not being overly focused on growth in a period of reforms.

Comments

Post a Comment